21++ How to adjust mortgage payable on worksheet accounting ideas

Home » Background » 21++ How to adjust mortgage payable on worksheet accounting ideasYour How to adjust mortgage payable on worksheet accounting images are available. How to adjust mortgage payable on worksheet accounting are a topic that is being searched for and liked by netizens now. You can Get the How to adjust mortgage payable on worksheet accounting files here. Find and Download all free photos and vectors.

If you’re looking for how to adjust mortgage payable on worksheet accounting images information connected with to the how to adjust mortgage payable on worksheet accounting keyword, you have come to the right site. Our site always gives you suggestions for seeking the highest quality video and picture content, please kindly surf and locate more informative video content and images that match your interests.

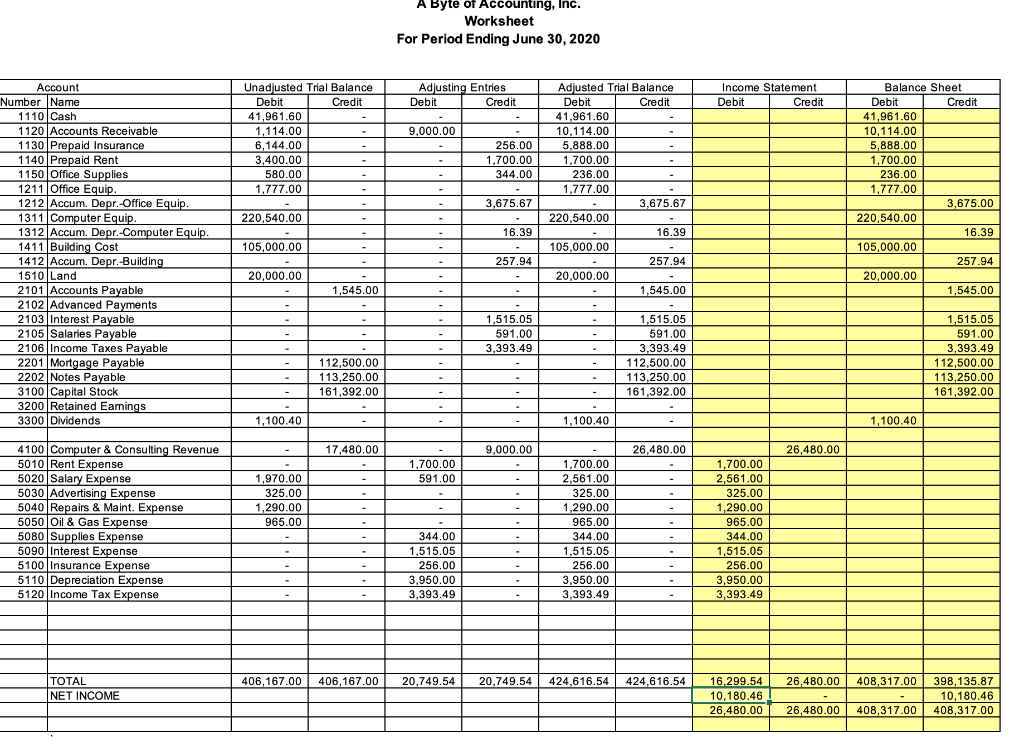

How To Adjust Mortgage Payable On Worksheet Accounting. Jeff an owner of a small furniture manufacturing company named Azon offers A-Z varieties of furniture. It is easier to account for business this way but for a mortgage company it is impossible to match revenues and expenses using this method To increase your effectiveness you should consider moving from cash to accrual accounting. Note payable 18000 Purchase a new truck April 1 bought new truck. In the future months the amounts will be different.

Beginning Accounting Can You Take A Look At This Accounting Accounting Jobs Accounting Notes From pinterest.com

Beginning Accounting Can You Take A Look At This Accounting Accounting Jobs Accounting Notes From pinterest.com

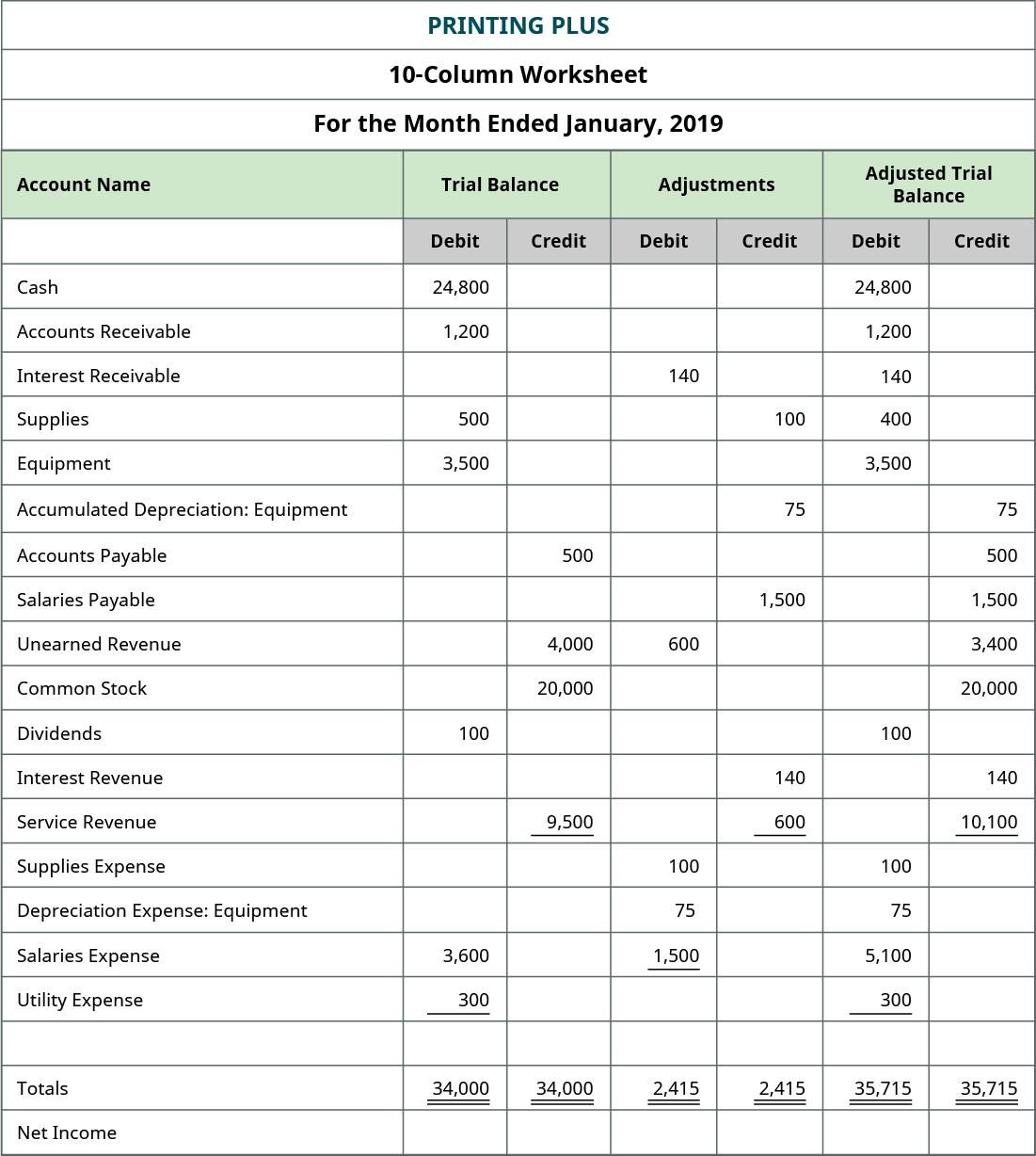

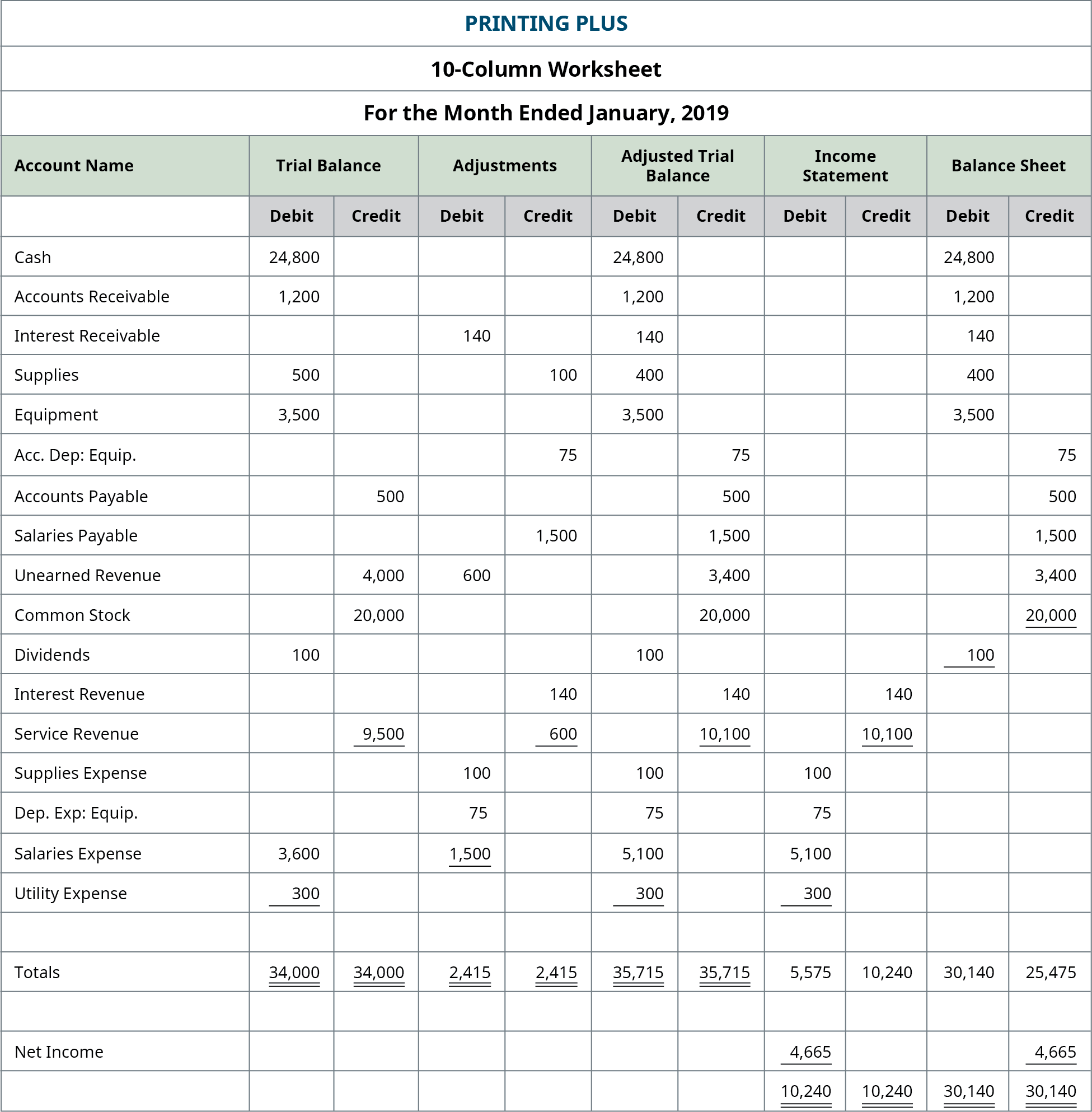

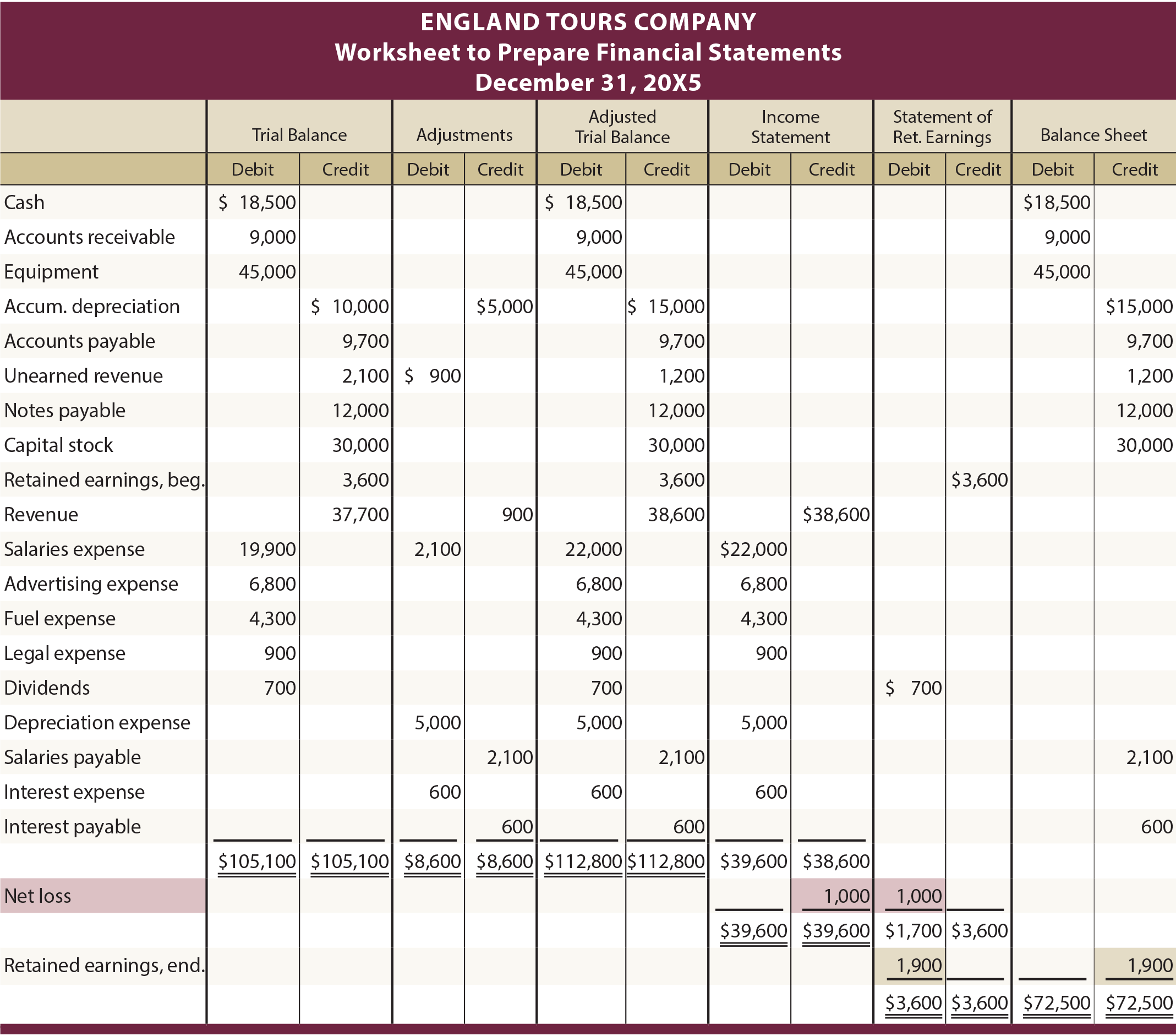

2 accounts payable decreases with a debit when Centerfield pays cash to remove a payable balance. Example of a Mortgage Loan Payable. An accounting worksheet is large table of data which may be prepared by accountants as an optional intermediate step in an accounting cycle. Prepare Unadjusted Trial Balance. A worksheet acts as a tool for an accountant and it is not usually intented to. This same process controls the data entry to make.

From the perspective of the borrower the mortgage is considered a long-term liability.

Invested 10000 cash in truck with remainder on a note payable. The company took a loan of 100000 for one year from its bank on May 1 2018 10 PA for which interest payments have to be made. Lets assume that a company has a mortgage loan payable of 238000 and is required to make monthly payments of approximately 4500 per month. At the moment the main goal for me is to keep track of incomesexpenses of our family over time. Any portion of the debt that is payable within the next 12 months is classified as a short-term liability. Note payable 18000 Purchase a new truck April 1 bought new truck.

Source: pinterest.com

Source: pinterest.com

Example of a Mortgage Loan Payable. Prepare Adjusted Trial Balance. Adjusting Entries Example 1 Accrued but Unpaid Expenses. Simply tabbing through the form will walk the user through the entry. Accounts payable for example is a liability account that increases with a credit.

Source: accountancyknowledge.com

Source: accountancyknowledge.com

Bonds Payable Bond Payables Bonds payable are generated when a company issues bonds to generate cash. Prepare Unadjusted Trial Balance. Accounts Payable 2500. The borrowing and receipt of cash is recorded with an increase debit to cash and an increase credit to mortgage payable. Under the agreement the lender commits to lend funds to a potential borrower subject to the lenders approval of the loan on a fixed or adjustable rate basis regardless of whether interest rates change in the market or on a floating rate basis.

Source: slideplayer.com

Source: slideplayer.com

When a payment is made mortgage payable is decreased debited for the principal portion of the payment interest expense is increased debited for the interest portion of the payment and cash is decreased credited by the payment amount of 162228. Maximum amount of the loan are set prior to funding. Bonds payable refers to the amortized amount that a bond issuer. Prepare Unadjusted Trial Balance. Liability and revenue accounts increase with a credit entry with some exceptions.

Source: pinterest.com

Source: pinterest.com

Any portion of the debt that is payable within the next 12 months is classified as a short-term liability. Mortgage loan payable definition AccountingTools. Prepare Adjusting Journal Entries. Total liabilities 5500 15500 Stockholders. Invested 10000 cash in truck with remainder on a note payable.

Source: slideplayer.com

Source: slideplayer.com

It is easier to account for business this way but for a mortgage company it is impossible to match revenues and expenses using this method To increase your effectiveness you should consider moving from cash to accrual accounting. Any portion of the debt that is payable within the next 12 months is classified as a short-term liability. An accounting worksheet is large table of data which may be prepared by accountants as an optional intermediate step in an accounting cycle. Either way you will need an adjusting entry so that your period end books show the proper amount of interest expense and mortgage payable. Liability and revenue accounts increase with a credit entry with some exceptions.

Source: in.pinterest.com

Source: in.pinterest.com

500 1000 Loan payable 5000. If the repayment term remains the same when you press calculate the payments will be adjusted so you can pay off the new principal in the same amount of time. It is easier to account for business this way but for a mortgage company it is impossible to match revenues and expenses using this method To increase your effectiveness you should consider moving from cash to accrual accounting. From the perspective of the borrower the mortgage is considered a long-term liability. Prepare Unadjusted Trial Balance.

Source: pinterest.com

Source: pinterest.com

Azon ends its accounting year on June 30. Total liabilities 5500 15500 Stockholders. Any portion of the debt that is payable within the next 12 months is classified as a short-term liability. This same process controls the data entry to make. Simply tabbing through the form will walk the user through the entry.

Source: accountancyknowledge.com

Source: accountancyknowledge.com

Land 90000 90000 90000 Total assets. A worksheet acts as a tool for an accountant and it is not usually intented to. Lets assume that a company has a mortgage loan payable of 238000 and is required to make monthly payments of approximately 4500 per month. Post credit entries on the right side of each journal entry. At most mortgage banks the biggest monthly expenses are commissions that are paid the month after the loans were closed.

Source: pinterest.com

Source: pinterest.com

The total amount due is the remaining unpaid principal. Any portion of the debt that is payable within the next 12 months is classified as a short-term liability. If the repayment term remains the same when you press calculate the payments will be adjusted so you can pay off the new principal in the same amount of time. This same process controls the data entry to make. Total liabilities 5500 15500 Stockholders.

Source: pinterest.com

Source: pinterest.com

Liability and revenue accounts increase with a credit entry with some exceptions. Prepare Post-Closing Trial Balance. I am new to double-entry accounting I use GnuCash for my personal family bookkeeping. 500 1000 Loan payable 5000. From the perspective of the borrower the mortgage is considered a long-term liability.

Source: chegg.com

Source: chegg.com

In the future months the amounts will be different. Note payable 18000 Purchase a new truck April 1 bought new truck. If the repayment term remains the same when you press calculate the payments will be adjusted so you can pay off the new principal in the same amount of time. The main purpose of a worksheet is that it reduces the likelyhood of forgeting an adjustment and it reveals arithmatic errors. Bonds Payable Bond Payables Bonds payable are generated when a company issues bonds to generate cash.

Source: ar.pinterest.com

Source: ar.pinterest.com

When a payment is made mortgage payable is decreased debited for the principal portion of the payment interest expense is increased debited for the interest portion of the payment and cash is decreased credited by the payment amount of 162228. Land 90000 90000 90000 Total assets. Lets assume that a company has a mortgage loan payable of 238000 and is required to make monthly payments of approximately 4500 per month. Post Adjusting Journal Entries. In the future months the amounts will be different.

Source: understand-accounting.net

Source: understand-accounting.net

A mortgage loan payable is a liability account that contains the unpaid principal balance for a mortgageThe amount of this liability to be paid within the next 12 months is reported as a current liability on the balance sheet while the remaining balance is reported as a long-term liability. Each of the monthly payments includes a 3000 principal payment plus an interest payment of approximately 1500. A worksheet acts as a tool for an accountant and it is not usually intented to. Land 90000 90000 90000 Total assets. A mortgage loan payable is a liability account that contains the unpaid principal balance for a mortgageThe amount of this liability to be paid within the next 12 months is reported as a current liability on the balance sheet while the remaining balance is reported as a long-term liability.

Source: opentextbc.ca

Source: opentextbc.ca

In the future months the amounts will be different. At the moment the main goal for me is to keep track of incomesexpenses of our family over time. Invested 10000 cash in truck with remainder on a note payable. Any portion of the debt that is payable within the next 12 months is classified as a short-term liability. Prepare Adjusted Trial Balance.

Source: pinterest.com

Source: pinterest.com

Either way you will need an adjusting entry so that your period end books show the proper amount of interest expense and mortgage payable. Adjusting Entries Example 1 Accrued but Unpaid Expenses. Prepare Adjusting Journal Entries. Note payable 18000 Purchase a new truck April 1 bought new truck. This same process controls the data entry to make.

Source: opentextbc.ca

Source: opentextbc.ca

Total liabilities 5500 15500 Stockholders. When a payment is made mortgage payable is decreased debited for the principal portion of the payment interest expense is increased debited for the interest portion of the payment and cash is decreased credited by the payment amount of 162228. At most mortgage banks the biggest monthly expenses are commissions that are paid the month after the loans were closed. Post credit entries on the right side of each journal entry. In the future months the amounts will be different.

Source: principlesofaccounting.com

Source: principlesofaccounting.com

Adjusting Entries Example 1 Accrued but Unpaid Expenses. Under the agreement the lender commits to lend funds to a potential borrower subject to the lenders approval of the loan on a fixed or adjustable rate basis regardless of whether interest rates change in the market or on a floating rate basis. At most mortgage banks the biggest monthly expenses are commissions that are paid the month after the loans were closed. The company took a loan of 100000 for one year from its bank on May 1 2018 10 PA for which interest payments have to be made. Accounts Payable 2500.

Source: pinterest.com

Source: pinterest.com

Bonds payable refers to the amortized amount that a bond issuer. It is unusual that the amount shown for each of these accounts is the same. This same process controls the data entry to make. Accounts Payable Accounts Payable Accounts payable is a liability incurred when an organization receives goods or services from its suppliers on credit. The company took a loan of 100000 for one year from its bank on May 1 2018 10 PA for which interest payments have to be made.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how to adjust mortgage payable on worksheet accounting by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 34++ Days months spelling worksheets ideas

- 25++ Spelling worksheets second grade oy ideas

- 23+ Ecosystem worksheets for 5th graders ideas

- 18+ Best spelling worksheets ideas in 2021

- 43+ Super teacher worksheets spelling grade 4 information

- 37+ Expanded accounting equation worksheet ideas

- 47++ Grace and the time machine spelling worksheets ideas in 2021

- 21+ Example accounting worksheet info

- 35+ Basic accounting worksheet template ideas in 2021

- 26++ Printable free spelling worksheets ideas