37++ Accounting payroll register worksheet answers ideas in 2021

Home » Background » 37++ Accounting payroll register worksheet answers ideas in 2021Your Accounting payroll register worksheet answers images are available. Accounting payroll register worksheet answers are a topic that is being searched for and liked by netizens now. You can Get the Accounting payroll register worksheet answers files here. Find and Download all royalty-free vectors.

If you’re looking for accounting payroll register worksheet answers images information related to the accounting payroll register worksheet answers keyword, you have pay a visit to the ideal site. Our site frequently provides you with hints for refferencing the highest quality video and image content, please kindly hunt and locate more informative video content and graphics that match your interests.

Accounting Payroll Register Worksheet Answers. Accounting Worksheet Problems and Solutions. Like compiling a task software letter in general certainly There are a selection of factors that require focus in compiling this Payroll Worksheet. Its important to know how its paid and provide examples of payroll taxes. Payroll Accounting Worksheets Answer Key.

Accounting Transaction Analysis Double Entry Bookkeeping Accounting Analysis Bookkeeping And Accounting From pinterest.com

Accounting Transaction Analysis Double Entry Bookkeeping Accounting Analysis Bookkeeping And Accounting From pinterest.com

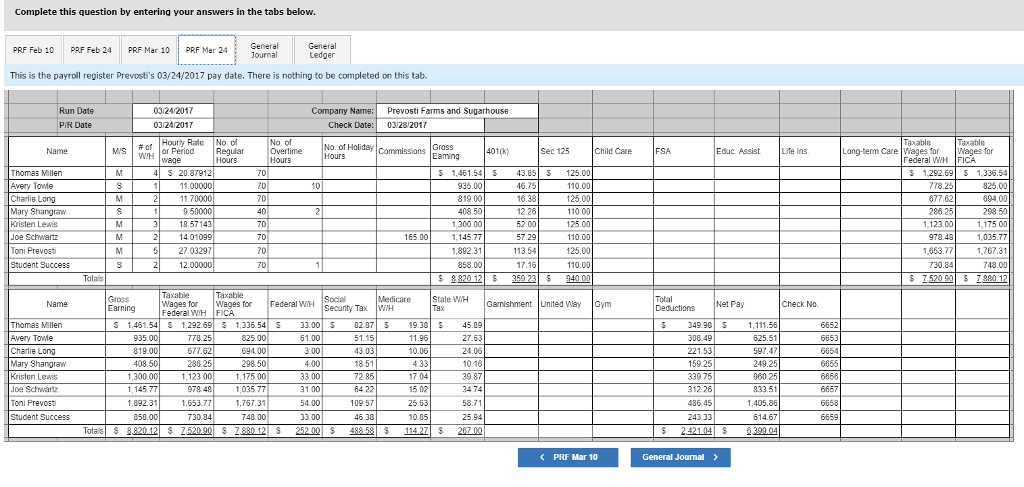

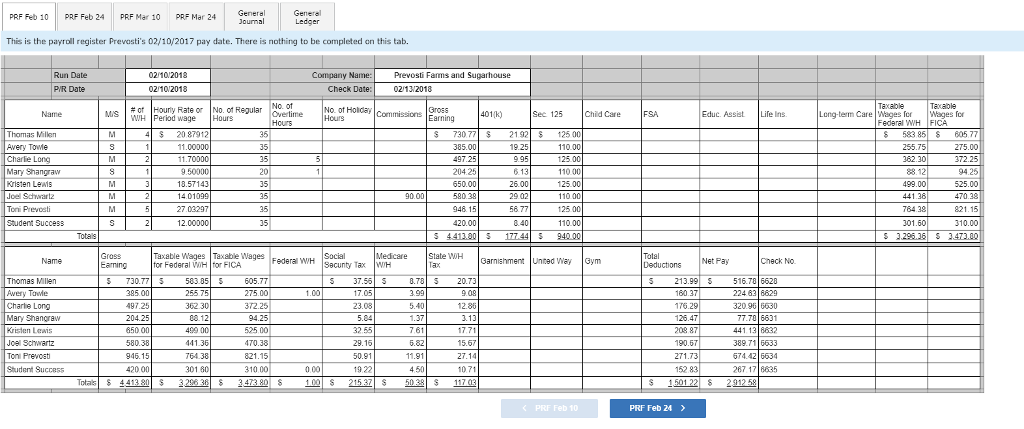

Payroll register this worksheet is wider than an excel screen and also glo. For an additional fee Peachtree Software has a payroll tax update service. The amounts needed for the payroll entries in the journal come from the employees earnings record. Jill is not correct. 5162017 Payroll journal entries are used to record the compen. If you want more practice with full accounting questions and answers you should get the official exercise book for this site Volume 2 in the Accounting Basics series.

PAYROLL REGISTER GLO-BRITE PAINT COMPANY Time Record Reqular Earnin Deductions Rate Per Rate Per Total NAME Hi 9 Payday December 4 20- For Period Ending November 28 20- 0 Bonno A 10912 13948 7936 8372 14310 7812 8816 12712 6250 6696 2552 3262 1856 1958 3347 1827 2062 2973 1462.

State the title in the focus on business. Describe the accounting and disclosure requirements for contingent liabilities. These journal entries ensure appropriate income statement and balance. Accounting questions and answers. Compute and record the payroll for a pay period. Following is the unadjusted trial balance as on 30 June 2018.

Source: chegg.com

Source: chegg.com

Payroll liabilities In most business organizations accounting for payroll is particularly important because 1 payrolls often are the largest expense that a company incurs 2 both federal and state governments require maintaining detailed payroll records and 3 companies must file regular payroll reports with state and federal governments and remit amounts withheld or otherwise due. An academic payroll worksheet lists out the staff working in the academic institution under question. Accounting Q And A. ANALYSIS Identify Classify Business Transaction Section 1 Journalizing and Posting the Payroll 341 3338-371_CH13_868829indd 34138-371_CH13_868829indd 341 991505 12639 PM1505 12639 PM. The total amount of pay due to an employee for a pay period before any deductions are taken a.

Source: pinterest.com

Source: pinterest.com

3A Prepare payroll register and payroll entries. All states have set their minimum wage to be the same as the federal government. Describe the accounting and disclosure requirements for contingent liabilities. Main Idea Gross earnings is the total amount an employee earns in a pay period. Test 123 Resources Filename.

Source: in.pinterest.com

Source: in.pinterest.com

These journal entries ensure appropriate income statement and balance. Workbook has 88 questions and exercises starting from the accounting equation and basic concepts to journal entries T-accounts the trial balance financial statements the cash flow statement. 5162017 Payroll journal entries are used to record the compen. Roadrunners payroll register in Figure 125 on page 320 is the source document for the payroll journal entry. The company Pensylvania employer page 7-50–complete the information worksheet needed for the first account number is 000-0-3300 EIN is 00-0.

Source: pinterest.com

Source: pinterest.com

The money paid for employee services a. 310 the different methods of computing gross pay. PAFSampPWRpdf - Read File Online - Report Abuse. All payroll systems have certain tasks in common as shown in Figure 121. Select the best answer and record the answer on the Scantron provided.

Source: pinterest.com

Source: pinterest.com

Read to Learn the two main functions of a payroll system. A current liability is a debt that. Jill is not correct. For an additional fee Peachtree Software has a payroll tax update service. 21 Payroll Payroll register.

Source: pinterest.com

Source: pinterest.com

The Payroll Entry window is the Payroll Journal. The money paid for employee services a. 5162017 Payroll journal entries are used to record the compen. Describe the accounting and disclosure requirements for contingent liabilities. Following is the unadjusted trial balance as on 30 June 2018.

Source: pinterest.com

Source: pinterest.com

Accounting questions and answers. Like compiling a task software letter in general certainly There are a selection of factors that require focus in compiling this Payroll Worksheet. About This Quiz Worksheet. When ABC Company issues Mary her payroll check for the most recent accounting period they would post the following entry to decrease debit the Wage payable account balance and payroll tax balance and decrease credit cashIn accounting software such as QuickBooksyou will credit the bank account you are paying your employee from2 Payroll Journal Entry For Salary Payable. A True B.

Source: fi.pinterest.com

Source: fi.pinterest.com

With this quizworksheet combination you will be tested on the subject of the payroll tax. A True B. PAFSampPWRpdf - Read File Online - Report Abuse. 21 Payroll Payroll register. Select the best answer and record the answer on the Scantron provided.

Source: pinterest.com

Source: pinterest.com

Is a manufacturer of various types of dyes for industrial use. Accounting Worksheet Problems and Solutions. Roadrunners payroll register in Figure 125 on page 320 is the source document for the payroll journal entry. 310 the different methods of computing gross pay. ANALYSIS Identify Classify Business Transaction Section 1 Journalizing and Posting the Payroll 341 3338-371_CH13_868829indd 34138-371_CH13_868829indd 341 991505 12639 PM1505 12639 PM.

Source: pinterest.com

Source: pinterest.com

PAYROLL REGISTER GLO-BRITE PAINT COMPANY Time Record Reqular Earnin Deductions Rate Per Rate Per Total NAME Hi 9 Payday December 4 20- For Period Ending November 28 20- 0 Bonno A 10912 13948 7936 8372 14310 7812 8816 12712 6250 6696 2552 3262 1856 1958 3347 1827 2062 2973 1462. The money paid for employee services a. Accounting questions and answers. Read to Learn the two main functions of a payroll system. Roadrunners payroll register in Figure 125 on page 320 is the source document for the payroll journal entry.

Source: pinterest.com

Source: pinterest.com

Roadrunners payroll register in Figure 125 on page 320 is the source document for the payroll journal entry. PAFSampPWRpdf - Read File Online - Report Abuse. Accounting questions and answers. Payroll Accounting Worksheets Answer Key. If you want more practice with full accounting questions and answers you should get the official exercise book for this site Volume 2 in the Accounting Basics series.

Source: id.pinterest.com

Source: id.pinterest.com

For an additional fee Peachtree Software has a payroll tax update service. 5162017 Payroll journal entries are used to record the compen. With this quizworksheet combination you will be tested on the subject of the payroll tax. State the title in the focus on business. PAYROLL ACCOUNTING REGIONAL 2009 PAGE 3 of 13 Multiple Choice.

Source: chegg.com

Source: chegg.com

Accounting Worksheet Problems and Solutions. All payroll systems have certain tasks in common as shown in Figure 121. Payroll liabilities In most business organizations accounting for payroll is particularly important because 1 payrolls often are the largest expense that a company incurs 2 both federal and state governments require maintaining detailed payroll records and 3 companies must file regular payroll reports with state and federal governments and remit amounts withheld or otherwise due. If you want more practice with full accounting questions and answers you should get the official exercise book for this site Volume 2 in the Accounting Basics series. Roadrunners payroll register in Figure 125 on page 320 is the source document for the payroll journal entry.

Source: pinterest.com

Source: pinterest.com

Payroll Accounting Worksheets Answer Key. Payroll journal entries are used to record employer-related compensation expenses and employee deductions. ANALYSIS Identify Classify Business Transaction Section 1 Journalizing and Posting the Payroll 341 3338-371_CH13_868829indd 34138-371_CH13_868829indd 341 991505 12639 PM1505 12639 PM. The money paid for employee services a. They do not reflect exact withholding amounts.

Source: pinterest.com

Source: pinterest.com

Payroll liabilities In most business organizations accounting for payroll is particularly important because 1 payrolls often are the largest expense that a company incurs 2 both federal and state governments require maintaining detailed payroll records and 3 companies must file regular payroll reports with state and federal governments and remit amounts withheld or otherwise due. All states have set their minimum wage to be the same as the federal government. PAYROLL REGISTER GLO-BRITE PAINT COMPANY Time Record Reqular Earnin Deductions Rate Per Rate Per Total NAME Hi 9 Payday December 4 20- For Period Ending November 28 20- 0 Bonno A 10912 13948 7936 8372 14310 7812 8816 12712 6250 6696 2552 3262 1856 1958 3347 1827 2062 2973 1462. The money paid for employee services a. The company Pensylvania employer page 7-50–complete the information worksheet needed for the first account number is 000-0-3300 EIN is 00-0.

Source: pinterest.com

Source: pinterest.com

These journal entries ensure appropriate income statement and balance. If you want more practice with full accounting questions and answers you should get the official exercise book for this site Volume 2 in the Accounting Basics series. For an additional fee Peachtree Software has a payroll tax update service. Jill is not correct. Here are a few of them.

Source: pinterest.com

Source: pinterest.com

The total amount of pay due to an employee for a pay period before any deductions are taken a. PAYROLL ACCOUNTING REGIONAL 2009 PAGE 3 of 13 Multiple Choice. Workbook has 88 questions and exercises starting from the accounting equation and basic concepts to journal entries T-accounts the trial balance financial statements the cash flow statement. Payroll Accounting Worksheets Answer Key. The Payroll Entry window is the Payroll Journal.

Source: pinterest.com

Source: pinterest.com

Involve a whole particular bio. Workbook has 88 questions and exercises starting from the accounting equation and basic concepts to journal entries T-accounts the trial balance financial statements the cash flow statement. About This Quiz. When ABC Company issues Mary her payroll check for the most recent accounting period they would post the following entry to decrease debit the Wage payable account balance and payroll tax balance and decrease credit cashIn accounting software such as QuickBooksyou will credit the bank account you are paying your employee from2 Payroll Journal Entry For Salary Payable. ANSWERS TO QUESTIONS 1.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title accounting payroll register worksheet answers by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 34++ Days months spelling worksheets ideas

- 25++ Spelling worksheets second grade oy ideas

- 23+ Ecosystem worksheets for 5th graders ideas

- 18+ Best spelling worksheets ideas in 2021

- 43+ Super teacher worksheets spelling grade 4 information

- 37+ Expanded accounting equation worksheet ideas

- 47++ Grace and the time machine spelling worksheets ideas in 2021

- 21+ Example accounting worksheet info

- 35+ Basic accounting worksheet template ideas in 2021

- 26++ Printable free spelling worksheets ideas